Big Brother, Spare a Dime?

- by

- Aug 02, 2016

- Law School, Law School Debt

- Reviewed by: Matt Riley

Going to law school is very risky. The Law School Transparency movement has helped a lot of people make the right decision.

Most law school aspirants are looking at $250,000 to $320,000 in debt and a 30% or more chance that they will not be working as lawyers after they graduate. There are over 100 law schools where your chances of not getting a full-time, JD required job are 30% or greater. Just look at the LST stats for yourself.

Keep in mind that a full-time, JD required job is a very low bar—most of these jobs won’t pay enough to help you make the required $2,000 to $3,000 in monthly loan payments.

If you can look at these numbers and you still think law school is a good idea, great. But you should at least know what you’re getting yourself into.

Precisely because of these numbers, law school enrollment has been going down since the financial crisis. And a lot of law schools are hurting.

Take Vermont Law School as an example. VLS is trying to get a $15 million loan form the USDA Rural Development Community Facilities Direct Loan Program to help it deal with a 33% drop in enrollment.

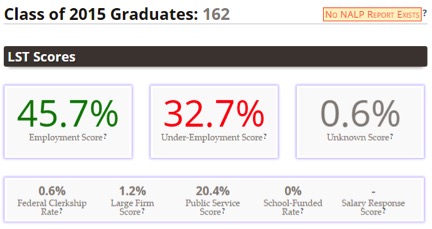

Here’s what VLS looks like on LST:

It will cost you about $250,000 for about a 2% chance of paying back your loans (add the Federal Clerkship Rate with the Large Firm Score for a reasonable estimate).

The USDA thinks that “Vermont Law School is a great example of an essential community facility that not only provides a vital service to Vermonters, but also anchors the community’s economy and culture.” Looking at VLS’s numbers, that doesn’t make a whole lot of sense to me.

Some law schools should close down. If a law school cannot attract students, they should downsize or close down. We have too many law schools and not enough jobs. The USDA shouldn’t be in the business of propping up failing law schools.

Search the Blog

Free LSAT Practice Account

Sign up for a free Blueprint LSAT account and get access to a free trial of the Self-Paced Course and a free practice LSAT with a detailed score report, mind-blowing analytics, and explanatory videos.

Learn More

Popular Posts

-

logic games Game Over: LSAC Says Farewell to Logic Games

-

General LSAT Advice How to Get a 180 on the LSAT

-

Entertainment Revisiting Elle's LSAT Journey from Legally Blonde