Managing Your Finances Through Med School and Beyond

- by

- Sep 01, 2022

- Reviewed by: Amy Rontal, MD

The following article is an interview between Dr. David Delnegro, an Emergency Medicine Attending, and Anthony DiMeglio, a financial advisor. In this interview, the two discuss financial wellness practices for those pursuing medical education, at each stage from pre-med to a practicing physician.

Dr. David Delnegro (DD): Hello there! My name is David Delnegro and I am an Emergency Medicine Attending with a passion for personal finance. I wanted to ‘virtually’ sit down with a financial advisor and answer through and talk about some of the most common questions you might have about financing your medical education. With me today I have Anthony DiMeglio, a fellow man of the 🇮🇹 pasta and someone I have been working with for 5 years now to turn my financial frowns upside down. Anthony, introduce yourself and your credentials:

Anthony DiMeglio (AD): Hello! Dr. Delnegro, thank you for having me here today. It’s an honor to spend some time with you. Speaking of pasta, if I recall correctly, the first time we met in person was during medical school and we actually had pizza for lunch! Pizza, pasta, can’t go wrong! As a further introduction, I have been a Financial Advisor with Northwestern Mutual since 2012. I have had the pleasure of working with clients from pre-med all the way to an attending physician. These days I spend my time running a national financial planning practice, focused on residents and attending physicians. I really enjoy helping physicians financially transition from their residency to their attending role, it’s always an exciting time, personally, professionally, and financially!

Pre-Med

DD: Excellent. Let’s get out of the spaghetti and into the meat sauce! First, we wanna talk about the very beginning:

How can you set up your med school finances as a pre-med student?

AD: As a pre-med student, I would start building up an emergency fund. Medical school comes with no income and a lot of debt. I believe it’s best to have a small nest egg before starting. I also believe it is important to build a good credit score during this time. This will make borrowing debt easier and cheaper.

DD: I agree entirely. To borrow from Dave Ramsey, a good emergency fund is ‘Murphy’s Law Repellant’. I also had friends who worked during their gap year (shout out to my old roommate Steve) who built up a nice fund that helped defray and soften some costs. A lot of premeds have the super big picture in mind. Is it too early to think about retirement as a premed?

AD: It is never too early! The earlier money can be invested the better the long-term outcome will be. However, I do not think retirement planning should be on the priority list.

DD: I imagine it is one of those things that depends on what you ‘did’ before going to medical school. Some of my friends owned businesses or were badass military veterans with PhDs (shout out to SuperCat!) and they probably have thought a lot more about it than your average 21ish-year-old guy or gal who is going straight through from undergrad.

How do you reduce the student loan burden as a medical student?

DD: Let’s switch gears. Medical school is painfully expensive but still is a net positive. I remember interviewing at a school and they put together this really good PowerPoint on the career earnings of a physician and why the investment into med school makes sense. Even so, it is painful early to be so headed in the wrong direction financially. What are your thoughts on things like scholarships? Working a side job to save up for tuition?

AD: I agree, it is definitely painful to watch your debt build up with the hopes and dreams that your physician salary will wipe away that debt. I think scholarships are a great way to reduce the student loan burden and I always advise applying for as many as possible. I always love a side hustle to earn income and to save for tuition. The less money that needs to be borrowed the better.

DD: Side hustles are so various and out there as well. One of my friends from residency started his own biotech company. Another breeds and works with horses.

As a pre-med, you can get on the tutoring train, which I highly recommend because 1) it’s basically being paid to study and 2) you learn the material at such a deeper level.

Before coming to Med School Tutors / Blueprint to teach everything from MCAT to ER Boards, I worked at Examkrackers for several years as a premed and medical student and it was super rewarding.

DD: Last on our pre-med train:

Where do most students trip up on the transition from pre-med to a medical student?

AD: I have seen people rent really nice apartments in expensive cities and use student loan money to cover these lifestyle expenses. While it is nice to live somewhere you like, it will increase debt and it will cost a pretty penny in the future.

DD: Ain’t that the truth? Especially if you are a student like many are, coming straight from undergrad or with a gap year at most, it can be hard to understand the value of a dollar. You see the nontraditional students who are second career or military vets understand the balances of lifestyle vs loans a lot better, talk to them. Some things are worth it. I did my residency in Reading, Pennsylvania and I had the choice between the suburbs in West Reading or Wyomissing or the city proper. The suburbs were 2-3x more expensive than the city proper but the city crime rate made it just way too dangerous for the savings I would get. On the other hand, some luxuries are superfluous. Find yourself a cozy place in an area that is safe and commutable but not too gaudy.

Pro tip: Ask your upper-year colleagues about the best places to live. They know where to go and where to avoid.

Med School

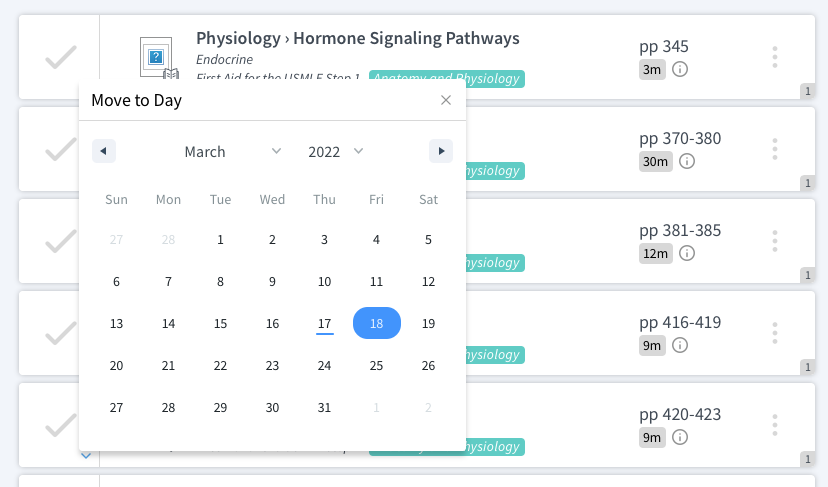

DD: Let’s move on to med school now. Many students struggle with how much to take out for loans.

Do you recommend taking out max loans or trying to budget your expenses?

AD: Budget your expenses. Loans tend to compound on each other and take years to pay off. There are plenty of loans that will be needed, so again trying to budget your expenses would be ideal.

DD: That compounding is dangerous too. Write yourself a little budget and take out what you ‘need’, not what you want.

Is there a role for saving and investing as a medical student?

AD: It’s tough. However, if the student is working a side job, then I believe it would be good to save a small portion of the income.

DD: Yeah, no perfect answer here. This is another place where just building basic savings will be helpful. It’s all about staying sane in the short term and not digging yourself too deep into a hole in the long term.

Where can most medical students safely tighten their budget and where is it just better to spend to keep your sanity?

AD: Housing expenses are a great way to tighten the budget. As we spoke about earlier, ask your upper-year colleagues. Most students don’t spend much time at home. In my mind, it’s better to spend money on food and entertainment to help keep the sanity. Food, drinks, and entertainment with family, friends, and co-students are good ways to get out and keep sane!

DD: Roommates can be your friend here, especially if you are childless. Cuts all the bills into smaller chunks that can make your money go farther. When I was at medical school, there was a house that like a dozen fourth years rented together, and since fourth years spend so much time away on rotations and interviews, it functioned almost like a hotel. It kept their housing expenses super low compared to prior years.

Residency

DD: Once you have scaled that Everest-like climb and gotten the big MD,

Where do most students trip up in the transition from medical school to residency?

AD: 80% of accidents happen on the way down Mt. Everest. We see the same thing here. Most new MDs are finally excited to have an income, they increase their lifestyle expenses dramatically and fail to realize that student loan payments are starting and the $60,000 or $65,000 is not nearly as much as they think it is. I believe at that time it’s also important to begin saving and investing and often times there is not much left.

DD: I heard some really good advice that says:

During your first year as a resident, live like a medical student (within reason). It will help you from accelerating your expenses beyond your salary because some money feels like a lot when the previous was no (actually negative given loans) income.

AD: Great advice!

How should you approach things like life insurance, disability insurance, and health insurance as a resident?

AD: Keep those expenses low during the first year. In regard to life insurance, disability, and health insurance, all of these are non-negotiable in my mind. Health insurance is provided through residency and the coverage tends to be good. Disability insurance is typically covered at 50% or 60% of income. It’s vital to purchase a policy outside of your employer that has a medical definition of disability and allows you to increase your coverage as your income increases. Think of disability insurance as insurance that is not only protecting your current and future income but also protects the years and cost of medical school. For life insurance, I would apply for the max allowable amount. It will never be as easy to get and affordable as it is now. This life insurance can be converted to whole life insurance once you become an attending. Whole life insurance serves as a permanent death benefit and a strategic asset in your financial plan.

DD: Sidebar, why do I need life insurance if I am young?

AD: As previously noted, it will never be as easy to get and affordable as it is now. This life insurance can be converted to whole life insurance once you become an attending. Whole life insurance serves as a permanent death benefit and a strategic asset in your financial plan. It’s important not to forget that life insurance is important to protect your family no matter how young you are. Not to bring down the mood here, but over the last 10 years I’ve had six clients pass away and their families are financially okay because of the planning they did.

DD: That is so sad, but a reminder that bad things do happen no matter what we do, and an ounce of prevention is worth a pound of cure.

DD: Okay, we are down to brass tacks now that we have an actual income:

How much should I be saving and spending as a resident physician?

AD: Of course, everyone’s lifestyle is different. However, it’s important to follow the 20, 60, 20 rule:

20% of income should be saved, 60% spent on essential expenses, and 20% spent on discretional, fun items.

DD: That is a nice shorthand. It is easy to use something like a spreadsheet or an app to help fine-tune those numbers to the desired ranges.

DD: Now after a few months, Uncle Sam comes calling:

How should I approach paying off my student loans?

AD: In many cases, residents use an income-driven repayment plan for their student loans. If you intend to work in a hospital that is in the Public Service Loan Forgiveness (PSLF) program, then it’s important to make every single required payment and to follow the requirements of the program.

DD: Perfectly said. Make sure to explore what plan works best for you. For the average case, it is often the Revised Pay-As-You-Earn (REPAYE) plan but you should talk to someone and make sure you have a plan and are on the right track.

DD: Back to fun for a second. Now we have a couple of wooden nickels in our pockets:

How do I treat myself (responsibly) as a resident?

AD: Yes, time to have fun–you deserve it! Similar answer to a medical student. Food, drinks, and entertainment with family, friends, and co-residents. Now with income, I see many people trying to carve out a few weekends to travel. This also tends to be a time when I see residents go through major life changes. For example, engagement, marriage, starting a family, or even buying a home.

DD: Those tend to be big expense items. Think carefully when you are a resident about how you are going to adjust your budget to pay for the big ring, wedding, or even kids. Also, we need not forget that traveling and having fun need not break the bank. As a resident and even junior attending, I love going to state parks. A combination of beautiful, fun, and free.

Practicing Physician

How do you manage the drastic shift in finances as a newly board-certified physician?

DD: Okay, now we are finally through the 11-15 years of education and college needed to become a doctor. Yikes, that was a long time. How can you avoid taking a look at the big check and making a bigger mess?

AD: I give you all a ton of credit, 15 years of education! Wow! The big check is appealing, especially after years of eating ramen noodles. However, over-extending the lifestyle too quickly is a mistake.

An income jump from $70,000 to $250,000 can make people do some silly things financially. The best thing is to continue the same lifestyle for a period of time. Once this income becomes the norm, then I believe it’s best to determine what lifestyle changes can and should be made.

DD: Borrowing from the adage earlier, best to live your first year as an attending as you did as a resident. Simple, powerful advice.

Which route should you take for your student loans: PSLF or refinancing?

DD: Now, your friends and family are excited to see you make it. So again is Uncle Sam. How do you decide whether to go down the PSLF or refinancing route for student loans?

AD: If as an attending, you are employed by the government, 501(c)(3) not-for-profit, or other not-for-profit organization that provides a qualifying service and you intend to stay there, then it makes sense to continue toward the program and have your loans forgiven. If your role does not qualify or if you intend to go private then you should refinance and receive a lower interest rate. Using a larger attending physician salary should enable you to refinance to a five-year, seven-year, or 10-year private loan.

DD: Advisors and such can be helpful here if it isn’t obvious which way to go is best. Some are easy. Have 600K in loans and only make 140K a year? PSLF is your friend. If those numbers are flipped? Probably best to aggressively refinance and hit the private market to get a better salary.

DD: Once you have figured out what track you are on:

How aggressively or leisurely should I pay down my loans?

AD: Well said, this is truly different for everyone and it’s important to review with an advisor. There are a few factors here: income, loan amount and interest rate, age, and current financial situation. Running a financial plan helps determine what is best.

DD: That comes back to the value of an expert:

A good plan will take so much of the guesswork out of things. A lot of the value here is offloading your brain as well.

I use this analogy all the time, but I have been working with a trainer at the gym from Tampa (Hi Rene!) to Reading (Hi Andrew!) to where I am now (Hi Christine!). It’s not like I don’t know how to work out or even write a plan, but having a trainer lets someone else write the plan, check my form, and document my progress. When you are as busy as you are as a doctor, it’s worth it to take things off your plate and long-term finance is one of those as well.

DD: Okay, rant over. Now that we have the big picture:

How do I maximize my savings and investments now that I make a larger check?

AD: Here are a few tips to take with you:

- At a bare minimum, save 20% of your income.

- Max out employer-sponsored retirement plans.

- Max out back door Roth IRA’s.

- Convert term life insurance into a cash-oriented whole life insurance policy.

- Open a brokerage account.

AD: With all of these accounts, it is vital that we are strategic from a tax standpoint. We need to keep Uncle Sam out of your pocket!

DD: Last, my favorite question, now in attending form:

How do I treat myself (responsibly) as an attending?

AD: Well, you deserve to do whatever you want! You have earned it! At a minimum, you can feel comfortable spending 20% of your income on yourself and your family. Kind of wild to think about, if you now make $300,000, that 20% is $5,000 a month to spend on yourself. Do the things you couldn’t afford to do in the past. In many cases, attendings work fewer hours and make 4x-5x more. This allows for more free time and more cash to enjoy this time.

DD: Anthony, thank you so much for spending some time to answer these questions. This work will hopefully provide a basic spotlight to so many soon-to-be and current docs and help them help themselves and help others.

Further Reading

About the Author

David is a very energetic, resourceful and resilient individual who pulls from a large toolbox of skills to help his students succeed in classes, exams, and challenging life problems. Many of his own experiences have been shaped by an almost seven-year career in Emergency Medical Services and disaster training. He has taught and tutored both the MCAT and the USMLE step exams employed as a freelance individual, a university employee, and for private companies. David also has additional mentorship experience during his time as EMS Sargent and Crew Chief. During his preclinical years, he founded a student organization that collected, edited and wrote new PowerPoint presentations so that second-year students for each class could have access to a bank of materials to use to tutor and teach the incoming first years. By providing his students with clear direction, goals, and expectations, David takes the guesswork out of study plans. A former MCAT practice material writer for Examkrackers, David has an advanced insight into the way tests and questions are designed and edited. He lives for seeing the look on his student's eyes when the light bulb pops above their head and is excited to bring a unique blend of humor, organization, and creativity to help you tackle any problem that comes your way. While David only tutors for the USMLEs, he heads our MCAT content creation team.