Four Reasons To Take Your Funny Money Seriously in Med School

- by

- Sep 12, 2017

- Reviewed by: Amy Rontal, MD

“Money isn’t real, George. It doesn’t matter. It only seems like it does.” ~ Fred Jung to George Jung, Blow.

This week, my attending was recounting a story of his daughter’s first experience with the tooth fairy. He told her that the tooth fairy would come and give her a dollar for her tooth. To this, she replied, “What’s a dollar?”

Medical school puts us in a similar position — not knowing what a dollar is. With tens of thousands of dollars for yearly tuition in one column, and “promise” (hope?) of a handsome salary someday in the other, it is all very abstract. As we pour money into our institutions, we earn very little and continue to dig a deeper and deeper pit. Living in debt takes an emotional toll on us. Every transaction we make, whether it be necessities like groceries and insurance, or luxuries like a drink at the bar with comrades, is a decision that can weigh on us — can I afford to spend my non-existent fiat money on this good?

There are two schools of thought when it comes to this type of spending. My hedonistic med school classmate told me his perception: “Debt is not even real. You’ll be making 6 figures this decade – live as much as you can while you can!”

While I’m all for living in the moment, the thought of equating spending with enjoying life didn’t add up for me. I was, and still am, married to my position of fiscal responsibility. And I am going to convince you to take this stance as well. Here’s why:

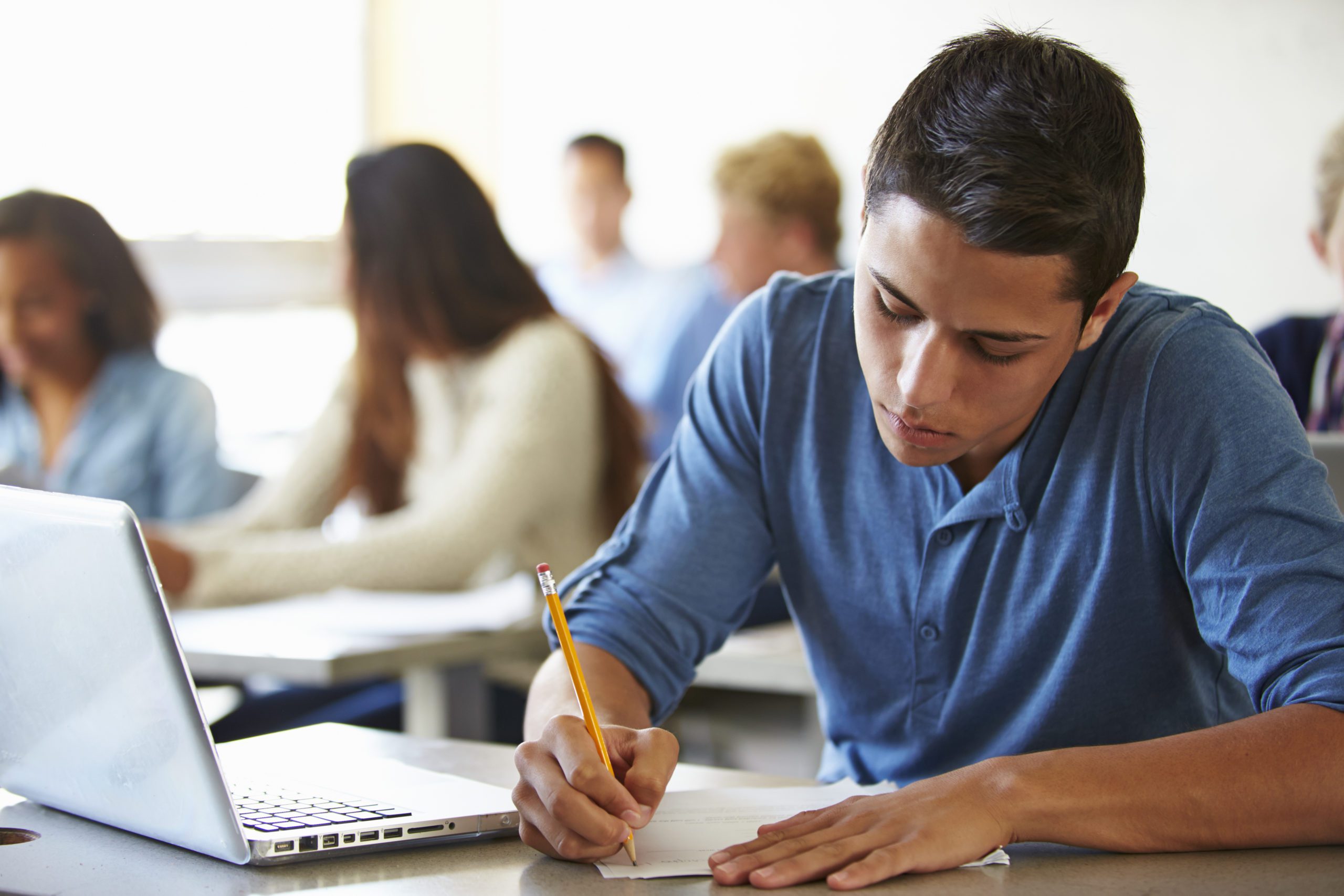

Reason #1: Your future is uncertain

So you think you know what your future holds. You will match into your specialty of choice, and live out your years earning at least the median salary that your field has to offer. You are above average, after all, right? In predicting the future, the only thing that you can be certain of is uncertainty. Could a family or personal event require you to repeat a year of medical school, forcing you to accrue larger loans and further putting off your salary earning years? Might you decide to obtain another advanced degree, such as an MPH or MBA along the way? Maybe familial obligations force you to practice in a high cost-of-living city with a saturated job market. Or personal injury cuts your career and earning power short. Worse yet, what if you don’t match, have $X00,000 in loans, and your future career as a doctor is hanging in the balance (the fate of my hedonistic friend above)? While we are all banking on being top earners in the very near future, it simply is not guaranteed. Approaching the future with less debt is always better than approaching it with more.

Reason #2: You don’t want to work forever

While it will be nice to be in the top 1% of earners in the United States when you are a fully functioning attending or private practice physician, demands of the job (as well as the loans to be paid) can get in the way of enjoying the fruits that said income can bring you. When will you experience complete freedom from the demands of the job, and have undisturbed swaths of time? Discounting sabbaticals, time in between jobs, and vacations (when your mind still might be on patient care), not until retirement. Although there is a good chance you will enjoy your work and want to continue to practice as long as physically and mentally able, the burned out cynic inside will want to get out and move on with some shreds of sanity. Incessant 80 hour weeks might turn you, the bright-eyed medical student, into one of those cynics. And, because no one wants to work forever, you must remember this: The time when you can safely retire depends upon how well you save. If you find a doctor in his or her 60’s who doesn’t enjoy their work, you can conclude they must not have managed their money well.

Reason #3: You want the ability to be more flexible with available jobs

It’s been said that there exists a 3-way trade off between geographic location, salary, and hours worked. Ergo, it’s impossible to live and work in a highly desirable location while making a relatively high wage for your field without putting in extra hours. You don’t want to have to sacrifice living in your city of choice, or be forced to take extra calls and hours because your previous spending habits necessitated a higher paying job. What if you were able to “afford” bringing home a smaller paycheck because of your fiscal responsibility, and could secure your dream job in dream city? The choice becomes easy.

Reason #4: You understand the magic of compounding

Compounding interest is an amazing thing when it’s working for you. It can cause your nest egg to balloon when invested and diversified properly. It is a travesty when the compounding is working against you, and instead working for your lender. For most medical students, this mighty borrower is none other than the U.S. Government. As of publication, rates on federal graduate program loans are 6%, compounded daily. To make matters worse, if you don’t pay off your interest in a timely manner, this interest will accrue further interest, driving you deeper into a seemingly bottomless well.

We know that paying for medical school can be an incredibly intimidating thing, and is often impossible without federal student loans. They are a necessary evil. What’s the solution? Borrow as little as possible. You may think that an extra few thousand dollars per year for spending money is inconsequential when you are borrowing $200,000 anyway just to pay your way. Well, the difference is real. Borrowing $10,000 extra dollars, even when paid back at $110 per month over 10 years, becomes a ballooned payment of $13,000+. Enough to buy you a dependable and awesome used car.

Stay tuned for part 2, in which we describe more reasons to temper spending the government’s monopoly money during medical school.